Whether you are in charge of your own business or you are managing a fleet of vehicles for a company, you will be amazed by just how useful a mileage tracking app can be. The apps in this list are good for everything from accurate journey coverage to ensuring you receive the maximum tax deduction that is available to you. Rather than just compile a list of basic gas mileage apps, we have sprinkled in a fair amount of variety with this list, so be sure to look at all of the features that are offered because you might just find something that revolutionizes the way you run your business or personal traveling.

The best mileage tracking apps for iPhone and iPad 2021

1 Oct 2021, by Christine Pamintuan

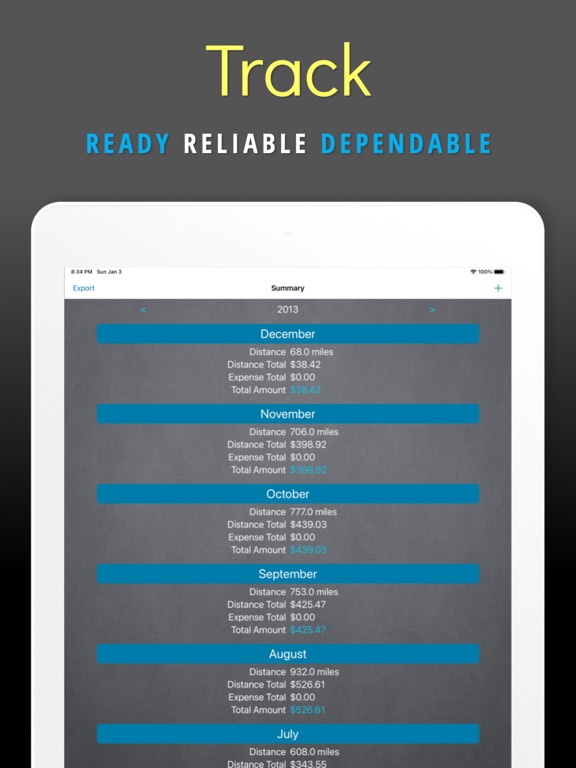

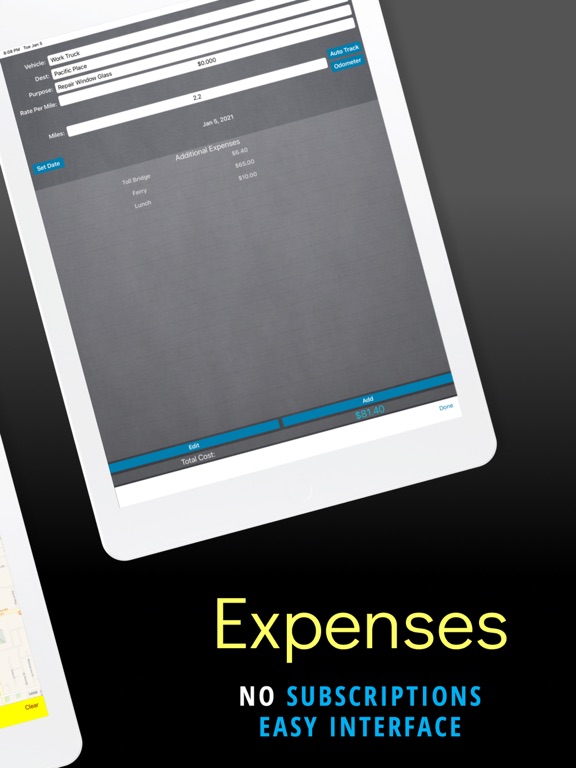

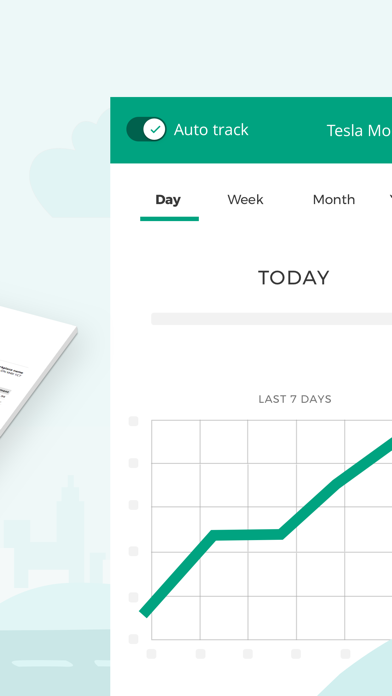

The Mileage Expense Log Tracker app is built for personal or business mileage and expense tracking. With the mileage tracking app for iPhone, you can track mileage via odometer, GPS, or direct entry. Easily add trip expenses (tolls, meals, etc.), view IRS reimbursement rates, and submit reports via e-mail. Sort by vehicle, date, purpose, or destination.

- Simple and intuitive user interface.

- Auto track mileage in the background, as you drive (requires device to have GPS enabled).

- Sort by date, purpose, and/or vehicle.

- Easy to read summaries.

- Add additional expenses such as tolls & ferries.

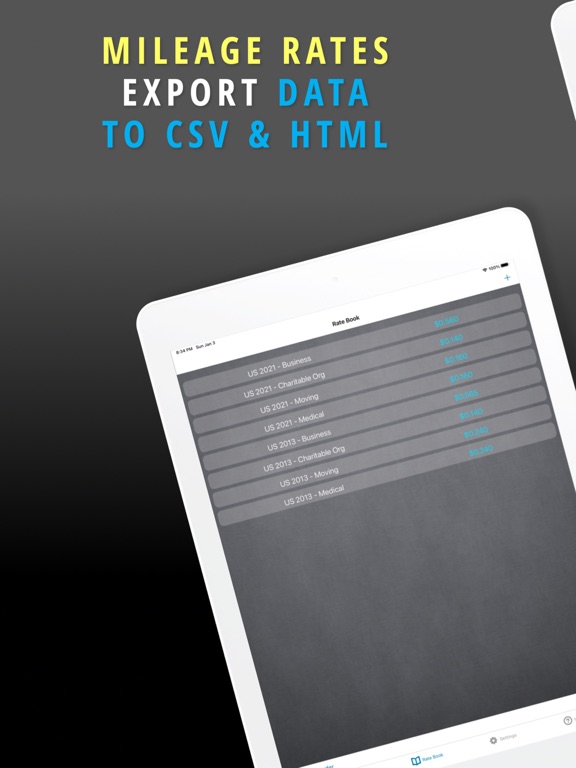

- Export database as HTML or CVS.

- Rate book for quick mileage rate reference.

- iOS Device to device database transfer.

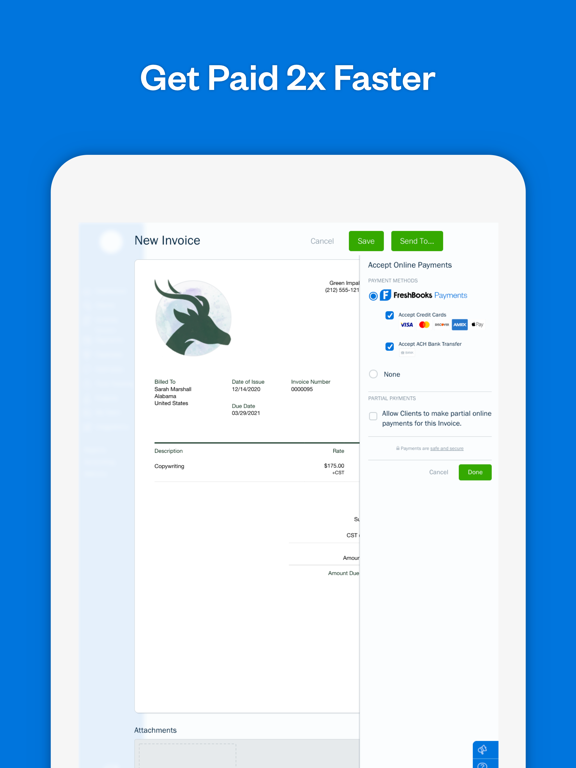

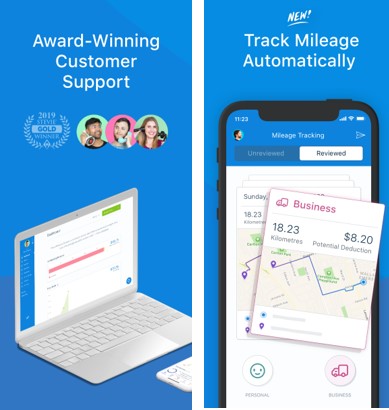

The FreshBooks Cloud Accounting app from FreshBooks is a comprehensive expenses tracker that includes a mileage tracking feature in the iPhone version which is good to have considering that travel costs form such a large part of our monthly expenses. Ratings are strong, and comments from users are very positive. With more than 20 updates since launch 5 years ago, it’s reassuring to see the developers care about quality.

- Classify trips as Business vs. Personal

- Offers custom tax reports by country

- Send invoices and capture expenses

- Mileage tracking included in all plans

Hurdlr tracks your mileage for the purpose of filing your taxes. It’s designed to track, gather and share your data with your accountant or have it handy for when you file your taxes yourself. The app provides live in-app support, automatically tracks miles, an estimator for expenses and tax deductions, self tax calculator, Payment alerts, personal cloud storage, and is light on your iDevice’s battery. Hurdlr is a safe and secure app that will definitely get the job done. This app is a great option for those of you that claim traveling expenses and mileage deductions on your taxes. Hurdlr app review

- Great app for mileage deductions on your taxes

- Automatically tracks your mileage

- Very light on your iDevice’s battery

- Estimator for expenses and tax deductions

- Calculator, Storage, Safe and Secure

QuickBooks is synonymous with keeping track of your expenses and budgets. This app will help you find tax deductions and keep you organized. The app has numerous in-app purchases which depends on the extensive features that you may want or need. One of the primary features is the mileage tracker which can be done automatically using your phone’s GPS. This helps users figure out the tax deductions allowed via the IRS. Additionally, users can track expenses on the go, attach receipts, view tax estimations, create or send invoices and much more. It’s easy to see why this is one of the best apps for self-employed individuals.

- One of the most trusted names in the industry

- Very thorough and extensive

- Automatically track your mileage

- Attach receipts, Create and Send Invoices

- Numerous in-app purchases

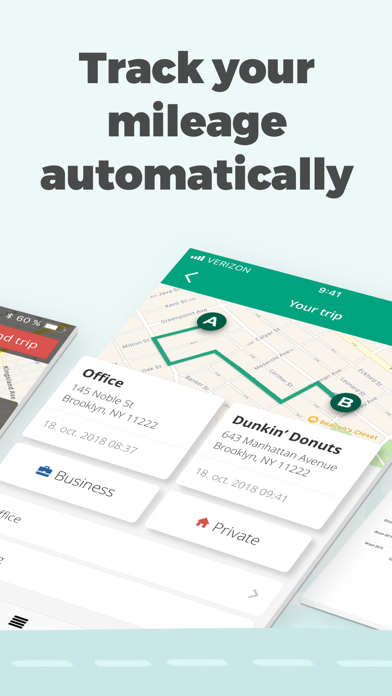

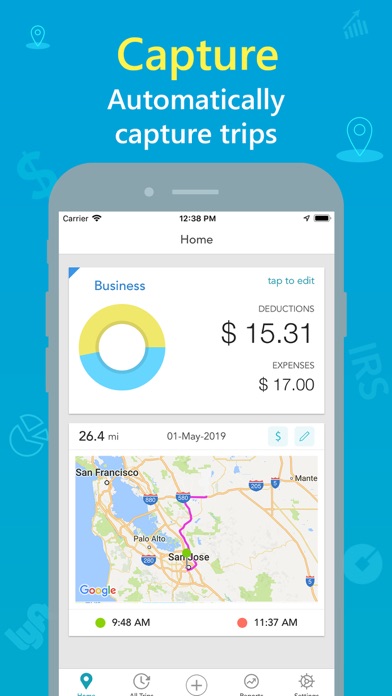

Mile IQ is a wonderful mileage tracking app that’s easy to use, quick to set up and efficient. Accurately track every mile you drive whether it be for work or personal, with a work vehicle or personal vehicle, and do this automatically. Log every drive, categorize drives, classify drives, receive personalized miles logs, tracking reports and much more. The built-in GPS makes this simple to use and worth your time to track mileage. When it comes time to file your taxes, Mile IQ will ensure that you have the accurate data needed to file your returns. There are in-app purchases. MileIQ - Mile Tracker & Mileage Log for Tax Deduction app review

- Built-in GPS to automatically track mileage

- Categorize your trips or drives

- Classify trips and drives

- Receive mile logs and tracking reports

- Mile IQ does have in-app purchases

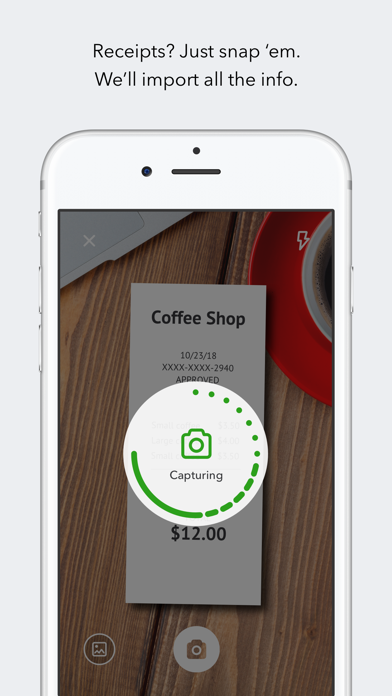

This mileage tracking app is 100% free and we love that about any app. Everlance is a mileage app that delivers some great features for personal and business travels. The app automatically tracks and logs mileage, trip start and end times, quickly categorize the trip, track revenue and expenses, add photos of receipts, an overview of taxable income, and quickly export all data via CSV. Another cool attribute about this app is that it’s designed to minimize the drainage on your iDevice’s battery while running in the background. Everlance app review

- 100% free app to track mileage

- Minimizes drain on your iDevice’s battery

- Track mileage, revenue and expenses

- Add photos of receipts for travel

- View taxable income, Export via CSV

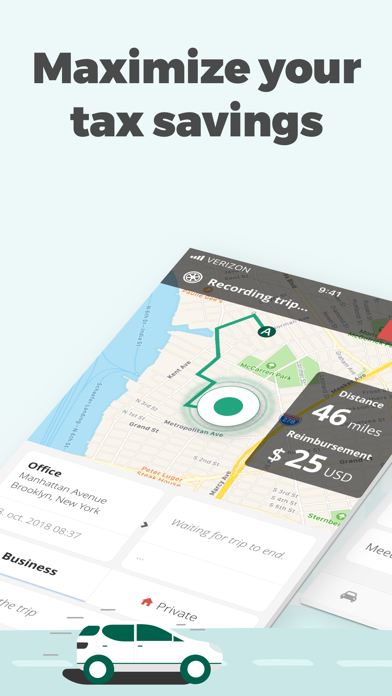

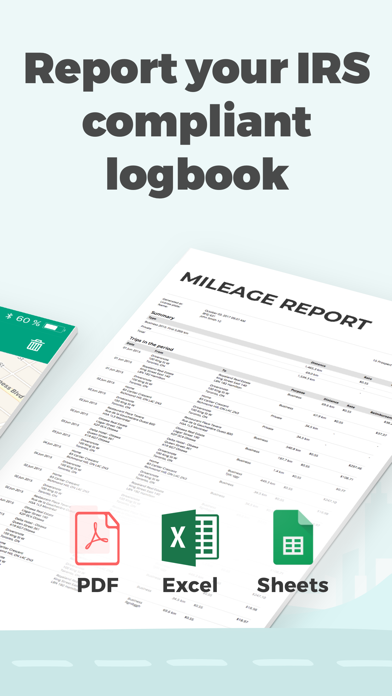

This app is extremely useful for those whose business is driving vehicles. Put your mileage logbook on autopilot: Let your phone track your trips, and have your mileage documentation ready for hand-over at any time. Place a Driversnote iBeacon in your car and the app will automatically record all your trips in the background. The app stops recording when you exit your vehicle, and you’ll get a notification that the trip was logged. Mileage Tracker is a great tool when you need:

- to record your trips on the go;

- to log who you visited & the purpose;

- to submit your tax compliant logbook;

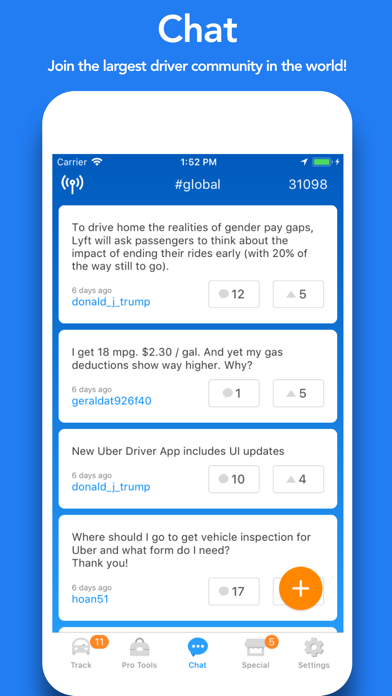

With its advanced mileage tracking technology, SherpaShare makes it easy for you to track your mileage for personal and professional use. Additionally, the app makes it convenient for you to get the best tax deduction with very little work on your part. The app is used by drivers from popular services like Uber and by millions of other individuals. Easily categorize your trips, track your expenses, securely back-up data to the cloud, connect and interact with a community of other drivers, view the busiest driving areas, check out the latest real time road conditions, get support and much more. This app really makes tracking mileage a simple and efficient process. Sherpashare app review

- Advanced mileage tracking technology

- Used by professional driving services

- Interact with a community of drivers

- View road conditions, busy driving areas, categorize trips

- Quickly and easily prepare data for tax purposes

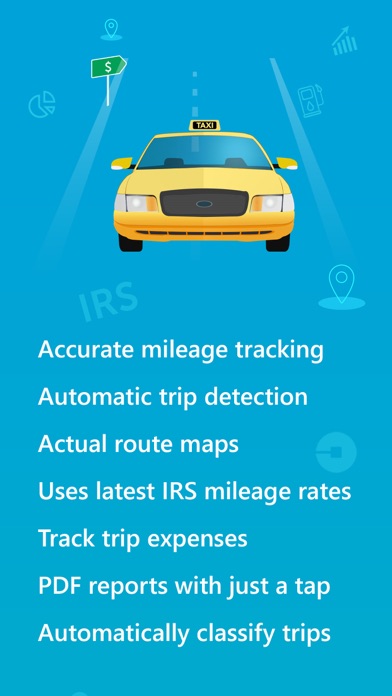

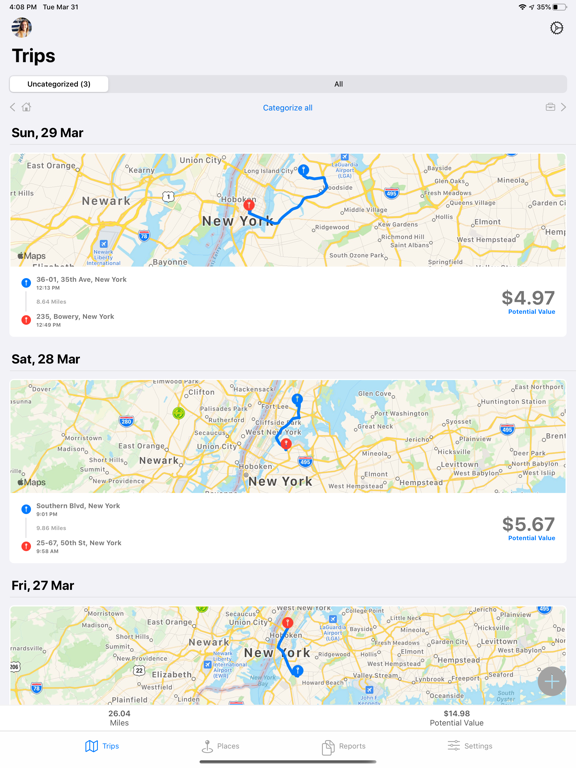

Swift Miles is a fantastic mileage tracking app that does most of the work automatically. That means you don’t have to remember to turn the app on or start tracking. It uses automatic trip detection, automatic mileage tracking and even automatically categorizes your trips based on past trips. This pain free app makes mileage tracking a simple task and is a perfect option for those of you who need to track miles and expenses for tax purposes. When it comes to tax filing time, simply send a mileage and expense report to your tax preparer. What separates Swift Miles from its competitors is the uniquely designed algorithm that limits battery drainage from continued GPS usage. All of the features are available for users. However, if you desire to use the app's automatic trip detection and tracking for unlimited mileage, then you will have to pay for the unlimited mileage tracking after 2 free months.

- Quickly and easily track mileage and expenses

- Automatic trip detection, Automatic mileage tracker

- Categorizes trips automatically, Send reports via PDF or CSV

- Swift Miles has a unique algorithm designed to not drain your battery due to GPS usage

- Latest IRS rates for tax deductions

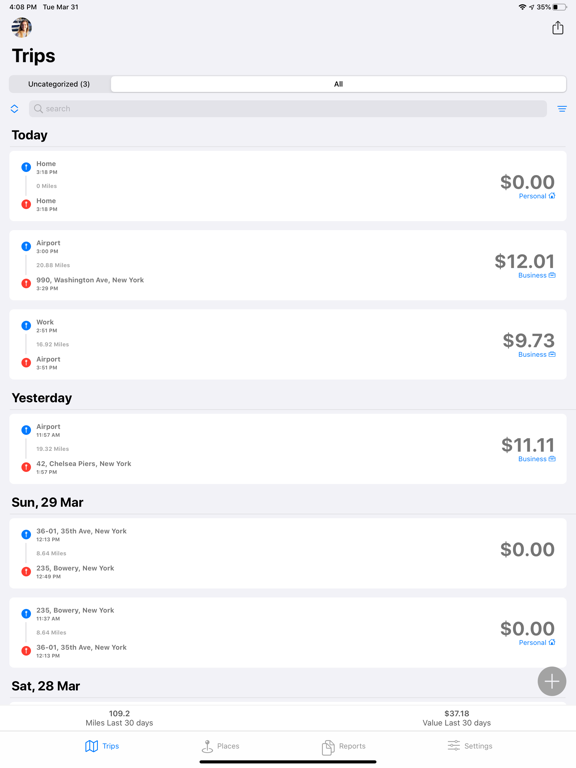

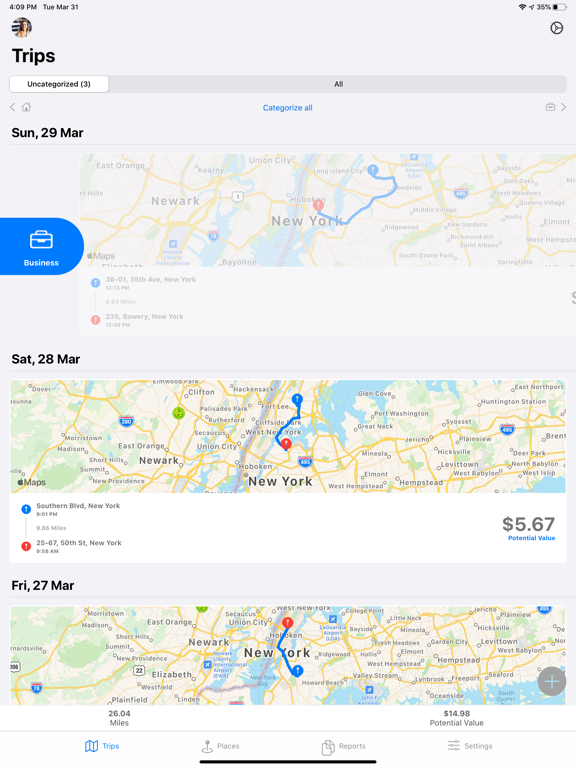

A unique mileage tracking technology, and a design to protect against IRS Audits, Milewiz is a wonderful option for automatically tracking your mileage and viewing your trips on a map. Additionally, the app allows users to see their recent trips and the value for each drive. Easily categorize drives, automatically set up categorizations, track expenses like gas and tolls, use for your clients, tag drives, use multiple vehicles and drivers, pause tracking when needed and so much more. There are subscriptions to get the most out of this app’s features and they renew automatically. You get 20 free trips per month before upgrading to unlimited trips at $4.99 a month. MileWiz a great app for small businesses and driving services in addition to the small family and individual drivers.

- IRS compliant, Easily generated and provide tax info

- Create multiple drivers, trips and vehicles to monitor

- Automatically track mileage, Pause tracking if needed

- Sync between iDevices, Advanced Categorization functions

- Subscriptions per month and year, 20 Free trips per month

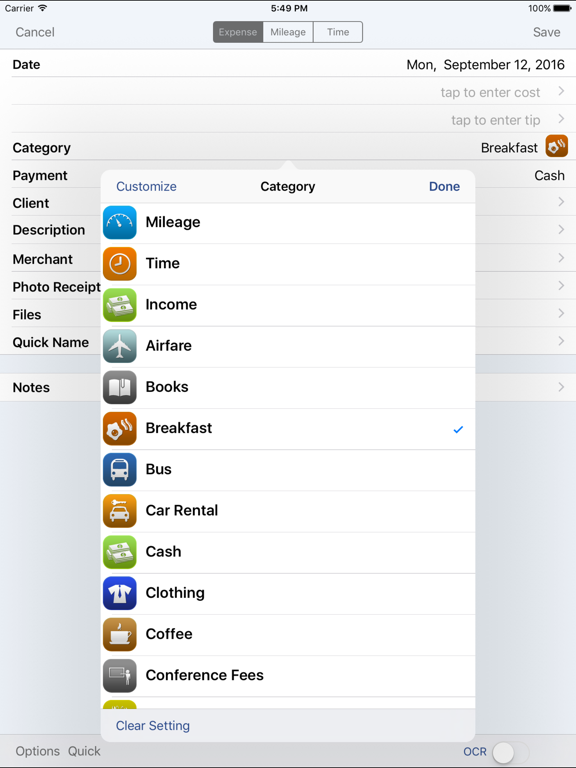

BizXpenseTracker offers an incredibly customizable approach to its functionality, enabling you to personalize the interface and various features to make things more efficient and streamlined for your business needs. This app enables you to track everything from daily business expenses to vehicle mileage, and the time taken to perform various tasks. For more on these tasks, check out our review. Detailed reporting features are available, and all of your data can be backed up via online cloud services such as Box and Dropbox. You can even take scans of your receipts and add location data to track where each individual transaction took place. BizXpenseTracker app review

- Track all kinds of business expenses

- Record detailed vehicle mileage data

- Tracks your running total costs

- Create numerous sub-categories

- Back up data via Box and Dropbox