If you’re like most people then you’re always looking for a way to save money, cut down on costs, and have more in your pocket at the end of the month. The following apps are dedicated to helping you figure out your personal finances from the fees you’ll pay on loans to creating your own budget and tracking all your spending habits. These apps can shed light on your personal finances and you may just find yourself with extra money for a change.

The best iPhone apps to calculate loans

30 Mar 2021, by Cherry Mae Torrevillas

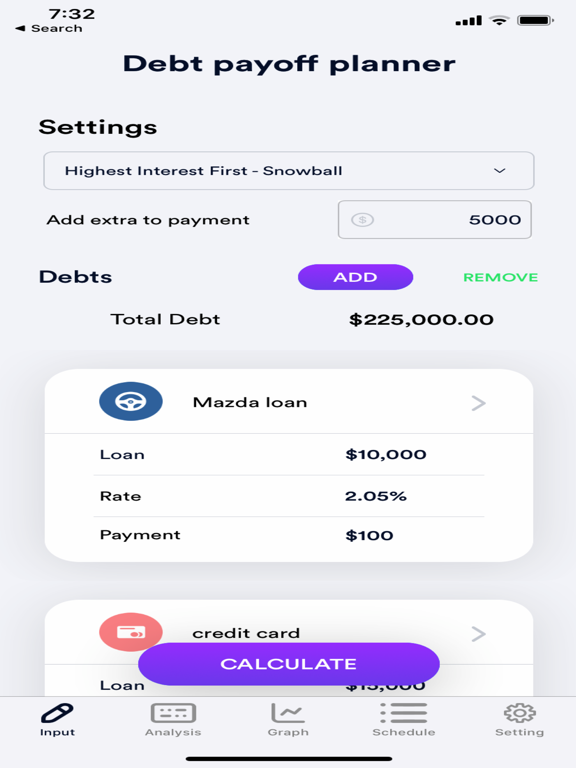

This is a debt manager app.

Debt Free Calculator app will help you to pay off your debts faster. Debt Free Calculator is an easy to use debt & loan calculator. The app lets you enter in various debts that you have and calculates the optimal payment strategy to get you out of debt as soon as possible.

- Detailed debt payment schedules

- Graphs

- Statistics on your debts

- Compare different payment strategies

- And much more…

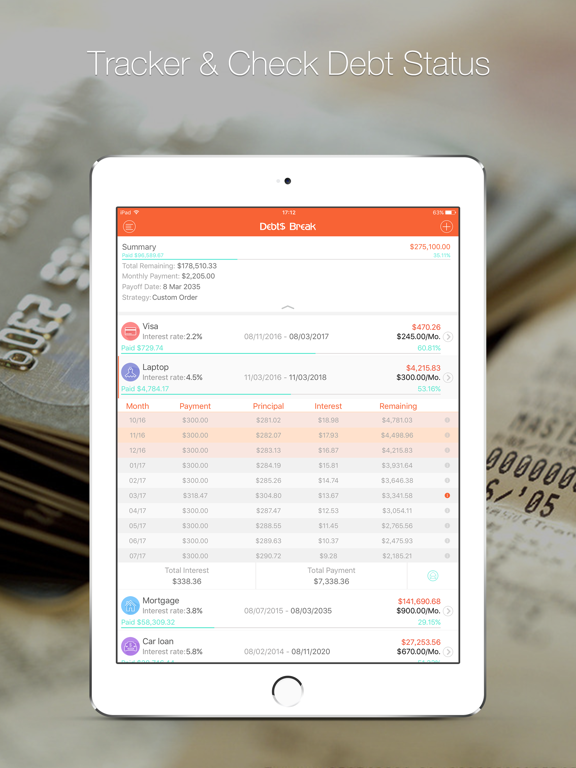

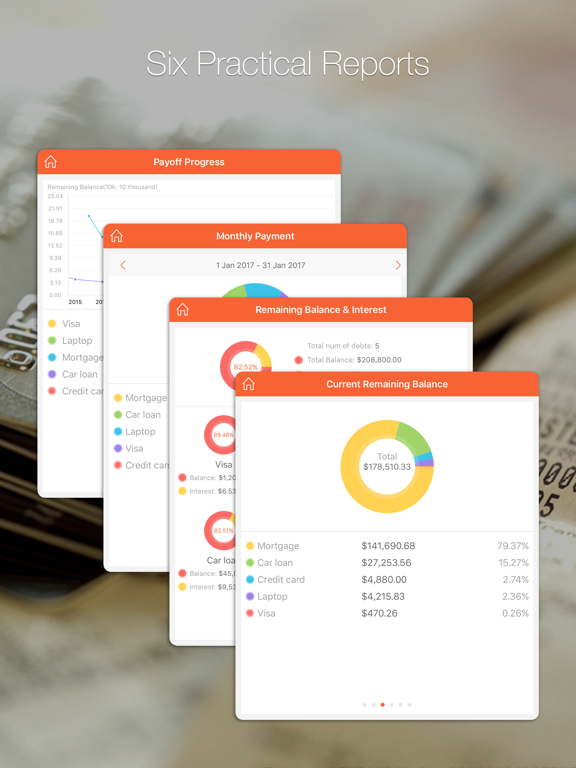

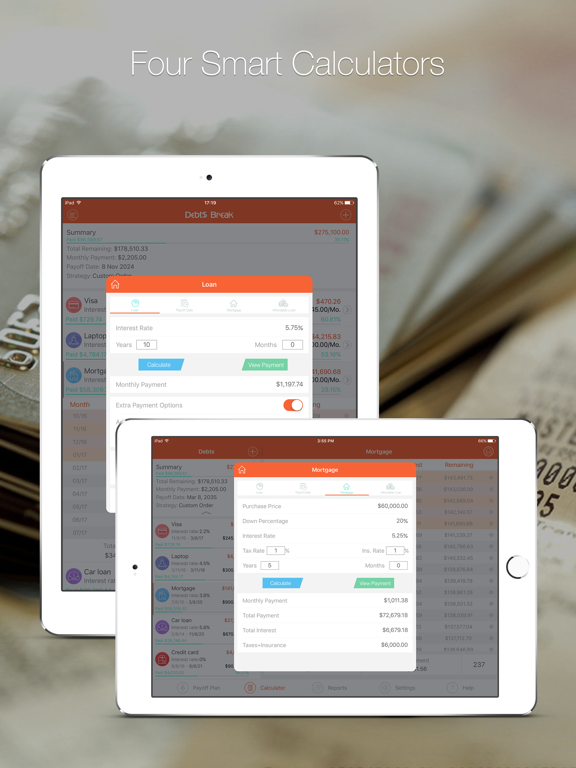

Are you familiar with the debt management solution called the snowball method? If not, then you will be very soon. This app helps users manage and reduce their debt through the “snowball method” and does so in a way that will really change the user’s financial spending ways. View the monthly payments, percentage of each debt, payment logs, remaining balanced, add notifications per bill or debt, pay off date, four different calculators, passcode protected, Touch ID, Wi-Fi backup, Cloud backup and many more features. There are in-app purchases to remove ads and for the snowball method.

- An app designed to help users become debt free

- View monthly payments, balance, paid amount

- List payment logs, Add notifications per debt or bill

- Filter options, Pass Code, Touch ID, Cloud backup, Loan Calculator

- In-app purchases for snowball method and ad removal

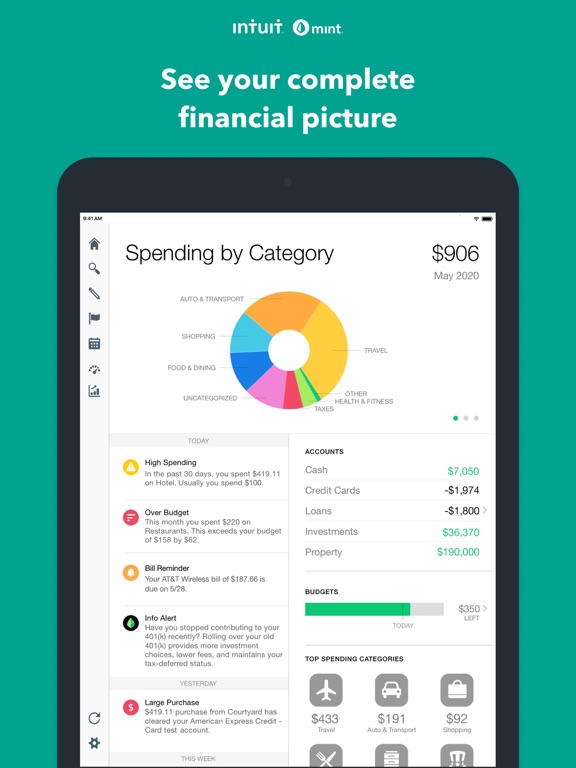

Sometimes it can be hard to track your finances and suddenly you're left wondering where all your money went. The Mint: Money Manager, Budget & Personal Finance app gives users a simple approach to managing their money. What's great is that everything will appear in one convenient spot: that means your investments, your credit cards, and of course your accounts. By having all this information on hand you can then set up bill reminders, track your spending, and of course create a customized budget. The app takes things further by giving users information on how they can save money and reduce the fees they are likely paying.

Mint.com Personal Finance app review

- Learn where your money is going by tracking your spending and income

- Create a budget within the app

- The app provides you with one central location to view your accounts, investments, and credit cards

- The app provides users with information on how to save money

- Set up bill reminders through the app

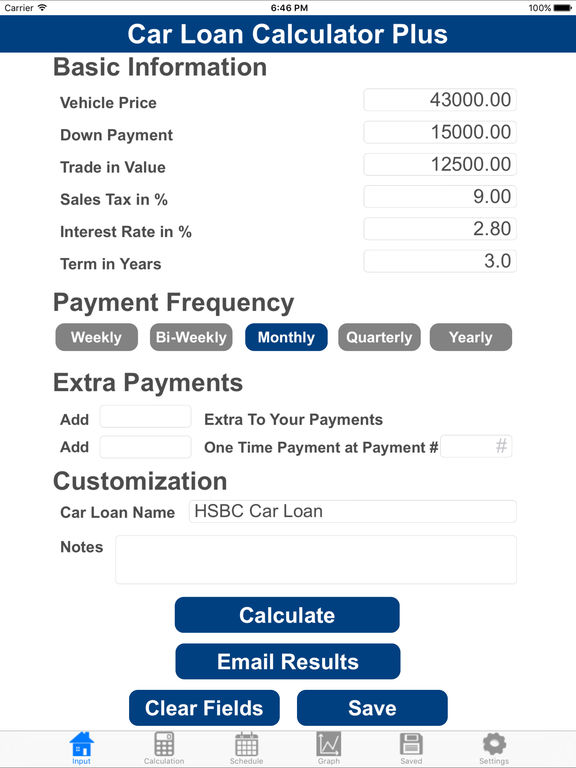

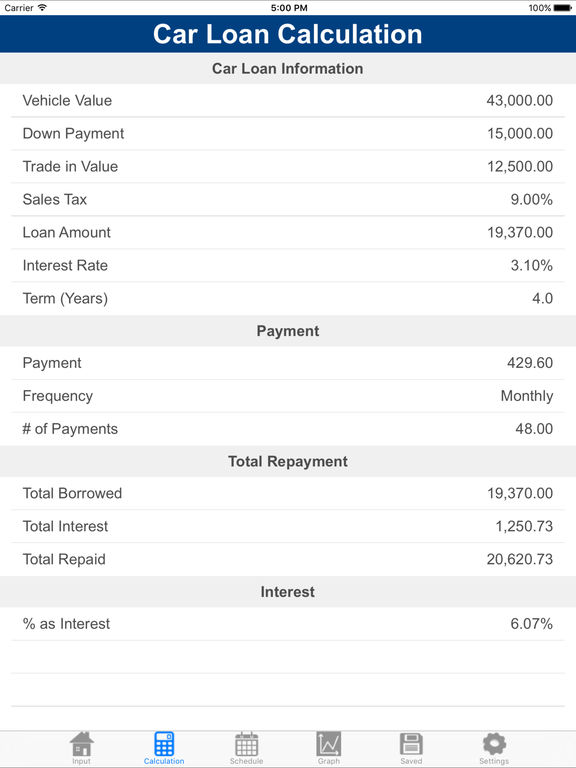

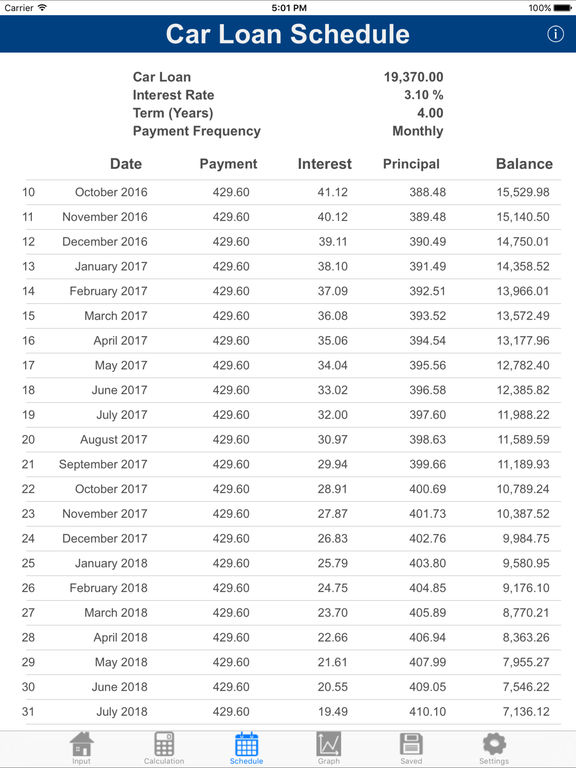

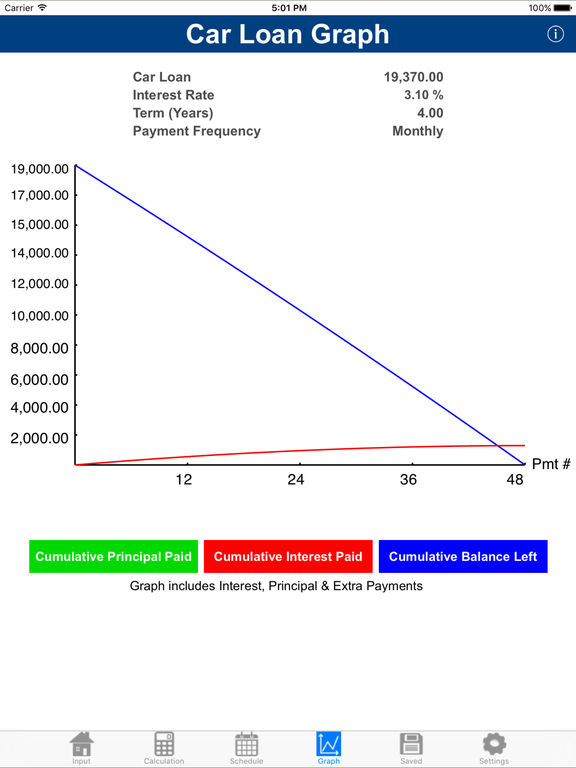

Car Loan Calculator Plus is the easiest to use Car Loan calculator available on the App Store. Car Loan Calculator Plus allows you to input extra payments, down payments, trade in value, sales tax and a whole bunch of other options to give you the most comprehensive car loan calculation. You can even change the currency symbol of your car loan to include $ £ € ¥. Car Loan Calculator Plus is perfect if you’re shopping around for a car loan, if you’re a dealership, a financial advisor or if you just want to learn more about your car loan.

- Car Loan Calculator Plus’ easy to use interface helps you make snap decisions.

- Unlike other car loan apps, Car Loan Calculator Plus gets rid of all the clutter.

- Dynamically build your amortization schedule right in front of your eyes.

- Includes graphing tools to help you see how much of what you’ll be paying is made up of interest and how much is actually going towards paying down your car loan.

- Email your car loan results to yourself or others.

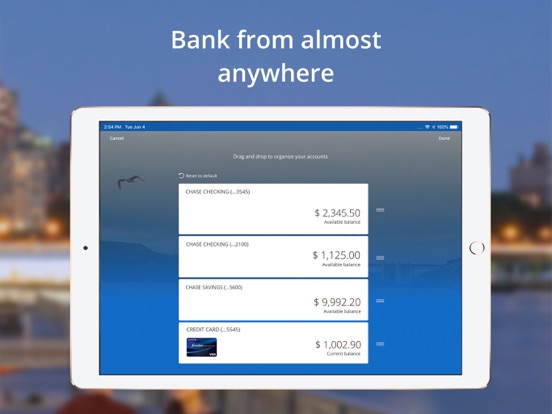

There's no need to head to your bank in person and never mind trying to get there during business hours because now you can perform your daily banking needs from your mobile device with the Chase Mobile℠ app. Because the Internet never closes you'll be able to perform banking 24/7 and work around your schedule for a change. Use this app to view your account balances, transfer money, pay bills, make deposits, make edits to pending transactions, send wire transfers, and view your credit card balance. The app features push notifications and customized alerts for a variety of functions and you can also check out your rewards balance. Chase MobileSM app review

- Perform all your daily banking needs 24/7

- Check your credit card balance, your account balance, and your rewards balance

- Send wire transfers, transfer funds between your accounts, make deposits, and pay bills

- Take advantage of the customized alerts and push notifications so you never miss paying a bill

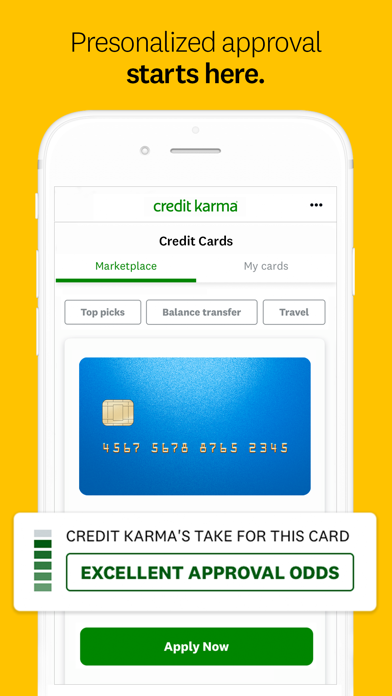

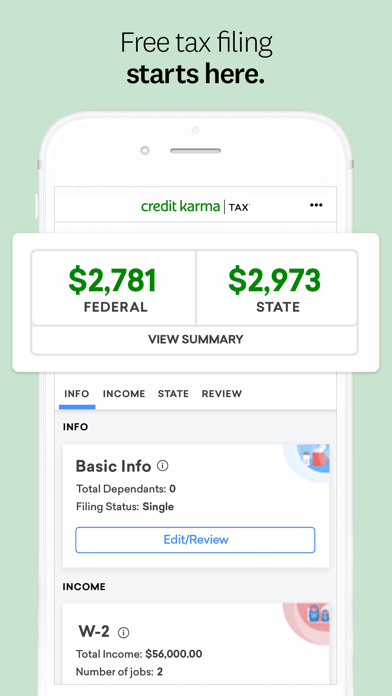

Before you apply for a loan or a credit card you may be curious to see what your credit score is. The Credit Karma Mobile app provides users with a quick, easy, and free way to get their credit score. This is also an excellent way to just see where you stand and make sure that all the information on your credit history is correct, as mistakes do sometimes happen and they can impact your rating in a negative way if not caught. The scores and reports are provided by Equifax and TransUnion so you know they are accurate and reliable. You can get weekly updates of your information if you like, get push notification, and even daily monitoring of your report.

Credit Karma Mobile App Review

- Learn your credit score and view a credit report

- The information is gathered from Equifax and TransUnion

- You can get weekly updates of your credit report

- You can set up push notifications and daily monitoring

Instead of downloading all kinds of apps to perform tasks you may want to check out the AppBox: Useful 11 Apps in One app which gives you a whole bunch of tools in one handy offering. This app provides you with information on the various currency codes, there is a mirror that you can zoom in on, you can view holidays in 83 different countries, there is a date calculator, there is a "days until" tool, and there is a loan calculator that allows you to key in all your details. There is a clinometer with three types of units and two levels, a menstrual cycle calendar, a price grab, a unit tool, and a tip calculator.

- There are 11 different tools in this one offering

- Each of the tools is user-friendly

- Save time and hassle from having to download all kinds of different tools, which also take up space on your device and clutter the screen

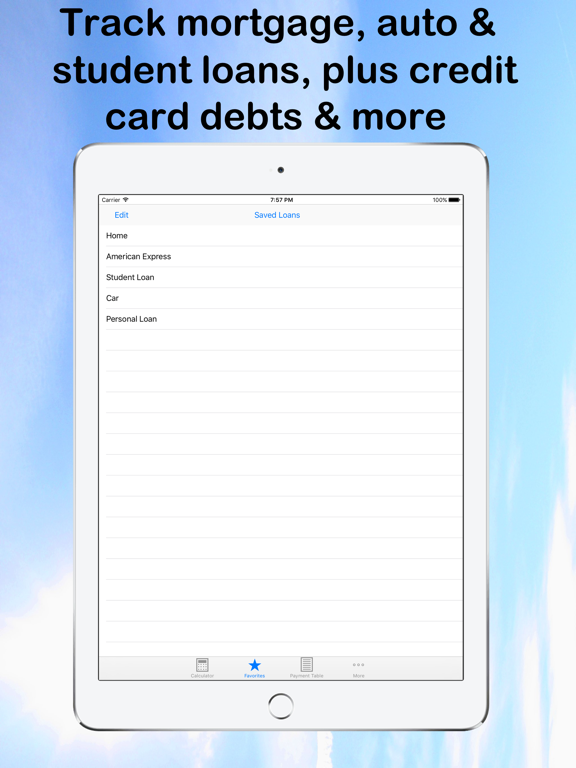

Before signing on the dotted line for that loan you will definitely want to be sure you're getting a good deal and that the payments are affordable. The Loan Calculator app helps you take a look at what a loan will cost you over time and what your monthly payment will be. This is perfect for car loans, making a major purchase on a credit card, and even big loans like a mortgage. The app uses a "What If" scenario that takes a look at how much time and money you can save if you also manage to make extra yearly or even monthly payments. Your loan calculations can all be saved so you can refer back to them at any time.

Loan Calculator app review

- The app will help you instantly figure out loan payments

- This can be used for both small and large loans

- You can save your loan calculations so you can refer back to them

- The handy “What If” scenario tool takes a look at how making extra payments can help the bottom line

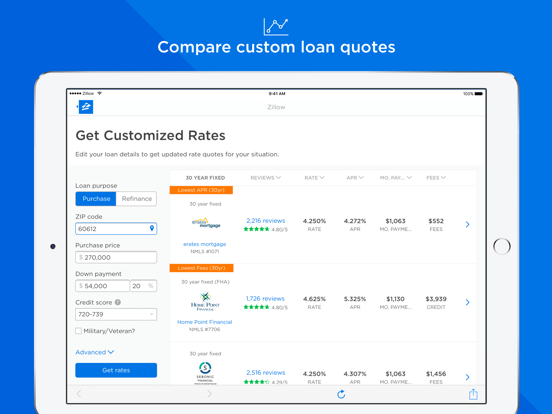

There's a good chance that a mortgage will be the largest loan you ever take out so with that in mind it's important to get the full picture before deciding on one. The Zillow Mortgages app can help you figure out what you can afford, first of all, and then break down your mortgage so you can see what the monthly payments would be. In the monthly calculation you'll also be able to view the taxes, interest, mortgage insurance, and principal. In order to ensure this app is as helpful as possible it offers real-time personalized mortgage rates that are based on your location. There is also a rate history tool so you can get an idea of what the rates have been doing over time.

Mortgage Calculator & Mortgage Rates for iPad app review

- Figure out what you can afford as far as a mortgage goes

- Get your mortgage payment and view the taxes, interest, mortgage insurance, and principal included in it

- Get real-time personalized mortgage rates that are based on your location

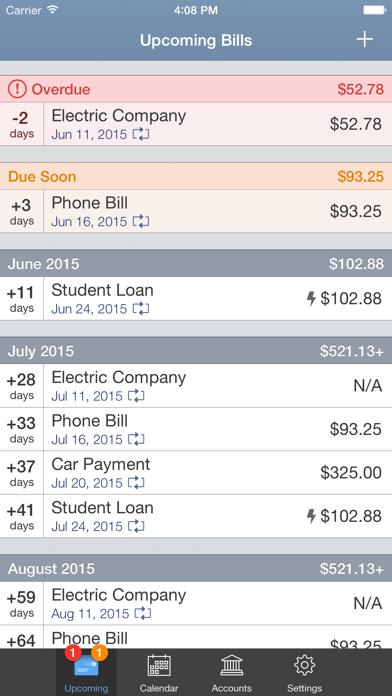

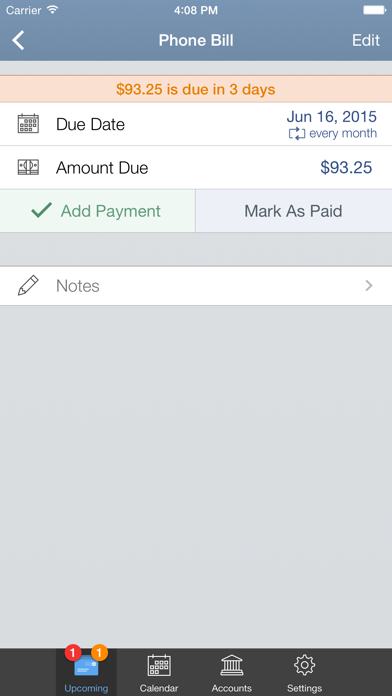

It's time to take that pile of bills off the kitchen table and start to organize them so that you never miss a payment or find yourself short on cash when a bill is due. The BillTracker Lite app provides users with some very useful features and tools that make it possible to keep your bills managed at all times. Each bill you enter allows you to key in the amount due, the due date, and if it is an automatic payment. Once the bill is paid you can key in the confirmation number. The app supports repeating bills, you can add a passcode to keep your information private, there are bill reminders, and you can view your account history.

- The app ensures you’ll never miss a bill payment again

- Set up bill reminders

- Enter in the confirmation number when you do pay the bill

- You can view an account history

- Everything stays organized and in one location

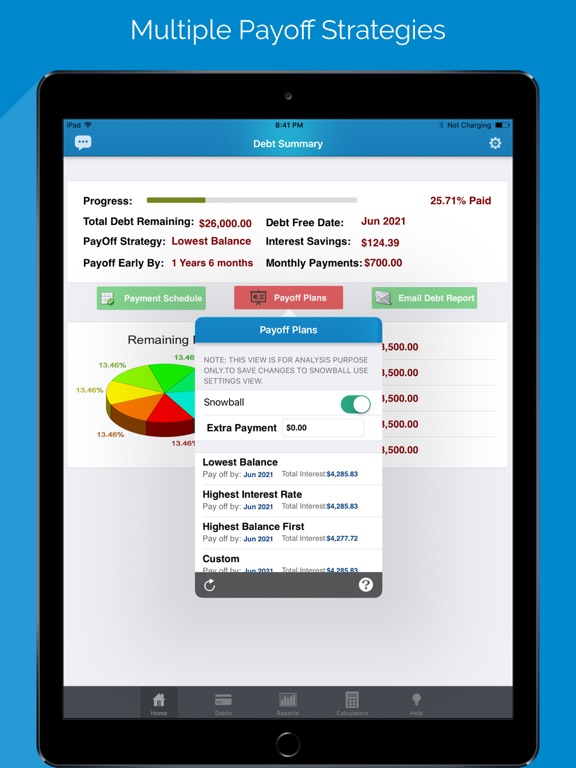

Being debt-free may seem like a pipe dream but with budgeting and hard work it can become a reality. The Debt Free app gives users a way to first of all organize all their debt, then start monitoring it as you may payments, and keep track of what you have paid off. There are calculators included in the app that will help you figure out the payments you need to make in order to become debt free. The percent paid progress bar acts as a great motivator, there is a payment due date notification so you won't forget a payment, you can check out charts and reports of your progress and debt still left to pay, and you can even research different payment strategies.

Debt Free app review

- The app is loaded with tools and calculators to help you become debt free as fast as possible

- Organize, monitor, and pay off debts

- View a percent paid progress bar

- View charts and reports of your debts still owing