It’s that dreaded time of year once again: tax season is upon us and most everyone is scrambling to get them done. If you want to tackle your taxes on your own there’s no need to feel stressed out and flustered because there are plenty of professional-quality tools that can help you out. The following list is a collection of apps that can help you do your own taxes and even file them and requires very little effort or stress on your part.

The best iPhone apps for doing your own taxes

30 May 2021, by Cherry Mae Torrevillas

This income tax calculator app can be a valuable tool for professionals and nonprofessionals alike. For a tax professional it will enhance your analytical ability, improve your day to day productivity and make tax planning more efficient. For an independent individual, this income tax app for iPhone provides an easy to use tool to analyze the tax impact of a transaction in terms of taxes saved or increase in tax liability, calculate a quick year-end tax estimate, perform a pre-tax-return-filing analysis and does even more for your convenience.

- Up-to-date with latest tax laws for 2020 and 2021 tax years

- Includes tax years 2021, 2020 & 2019

- Includes Qualified Business income deductions

- Automatic check for AMT applicability and analysis

- Computes Net Investment Income Tax

- Performs deductions and exemptions phase-out and MUCH MORE!!!

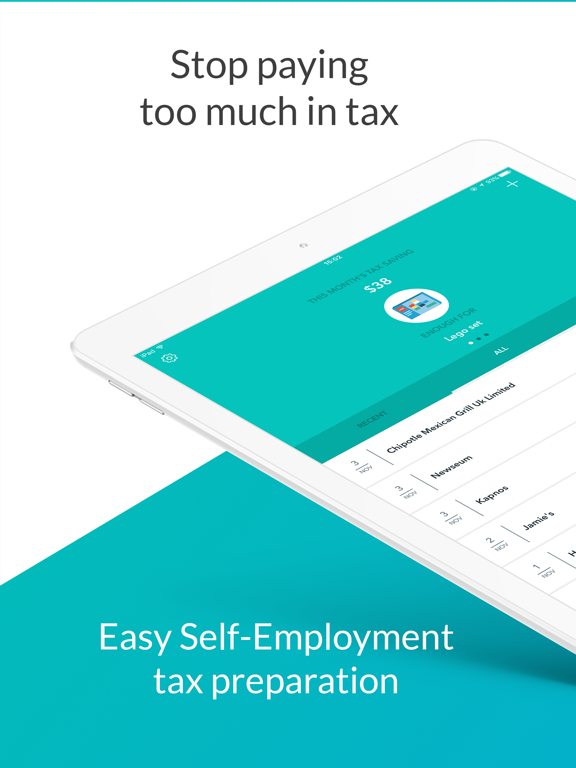

1tap receipts takes away the difficulty of organizing, tracking and filing business expenses, so you can focus on your business. Scan receipts to automatically extract the data and categorize transactions for your Schedule C. Start tracking your expenses for next year’s tax season by saving your receipts and get a head start on your records so you don’t miss a single deduction or expense.

- Open 1tap receipts and use the scanner to snap your receipt or invoice

- Data from the receipt or invoice is automatically extracted and placed in the correct Schedule C category

- Send your receipts and Schedule C categorization to your accountant or whoever else

- Featured by Apple as an app of the day

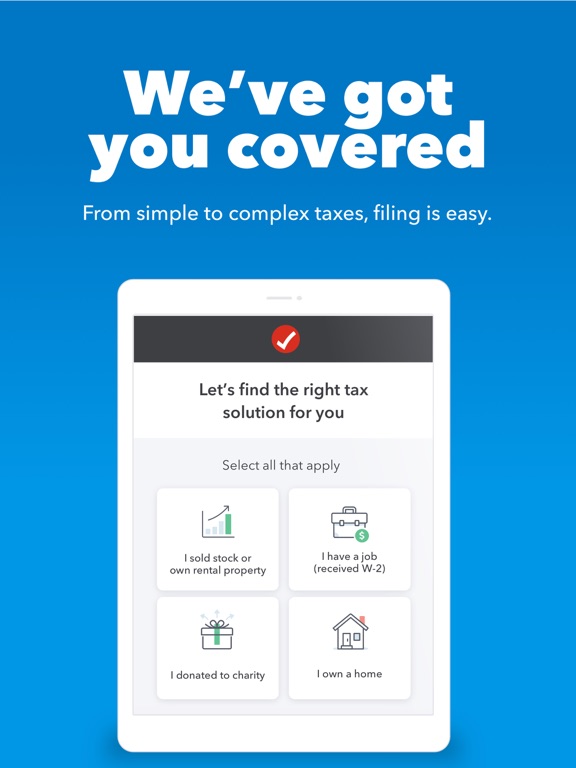

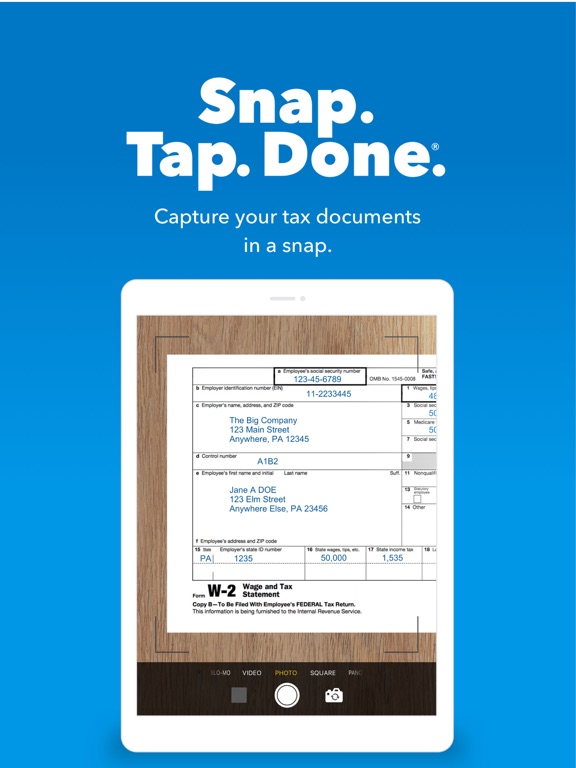

With a name like TurboTax Tax Preparation you know you're getting an app that is professional and able to handle your needs. Through the tools offered in this app you will be able to complete your 2014 income taxes and then e-file them, all in the same app. The way this one works is that you need to take a picture of your W-2, go through the questions that are asked, and then when you're done it's time to send it off. This app allows you to sync among devices so you can start on one and then pick up on another device. When it comes to tax credits and deductions the database has more than 350 options to learn about and apply to your taxes.

TurboTax Tax Preparation app review

- The app provides users with a way to complete and e-file their 2014 income taxes

- Begin by taking a picture of your W-2

- You will be asked a series of simple questions

- The app has a database of more than 350 tax credits and deductions you can apply to your taxes

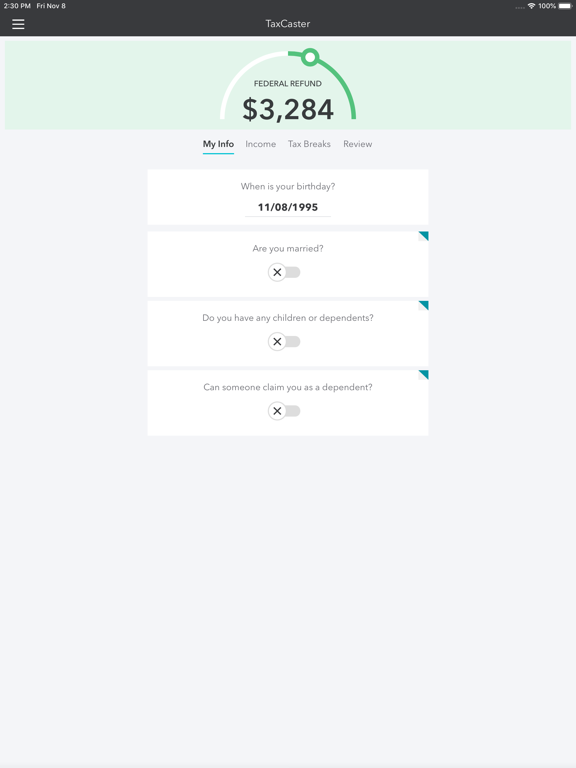

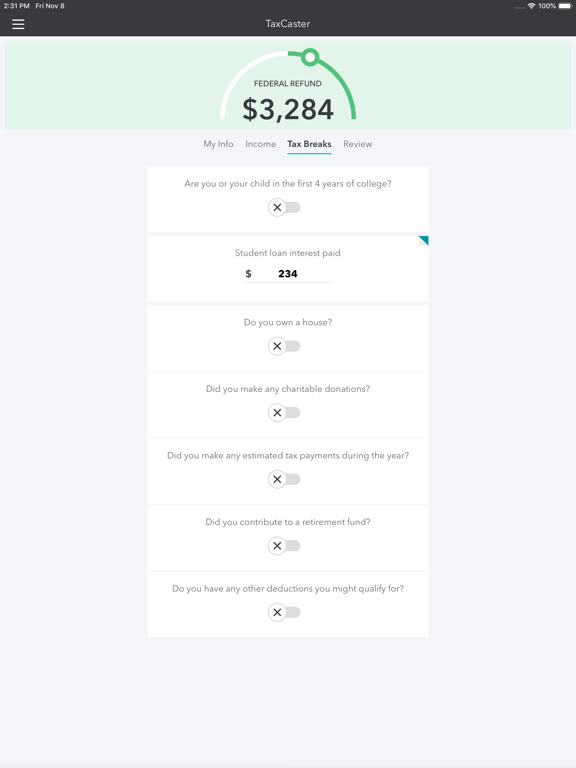

Taxcaster provides users with a quick estimate on their taxes. This is great for users who are trying to see what kind of refund they may be getting. The app uses the same tax calculator found in TurboTax, so it has reliability for those doubters. Your quick estimate can help you better prepare your tax forms, possibly go to a tax professional, or just give you some peace of mind heading into tax season. This app does not prepare your taxes, but will recommend the best TurboTax product for you.

TaxCaster by TurboTax for iPad app review-2020

- Get an estimate on your potential tax return

- This app does not prepare your taxes

- This app will recommend the best TurboTax product

- Can help users better prepare their tax returns

- Can help users decide if they want a professional do their taxes

Here’s another tax app option for those of you looking to get an idea of glance at your potential tax return for the year. Use your paycheck or W-2 and fill in the information required on the screens. From there, the app will work its tax magic and give you an estimated tax return based on the information you entered. This app does not prepare or file your taxes, but it can help you better understand what your financial situation looks like before you officially file. It has a smooth interface and a quick navigation to make this whole process a quick one.

- Use your paycheck or W-2 to get an estimated tax return

- Quickly and simply enter the information

- Does not file taxes for you

- Will not prepare your taxes

- This is just an estimate not an official return

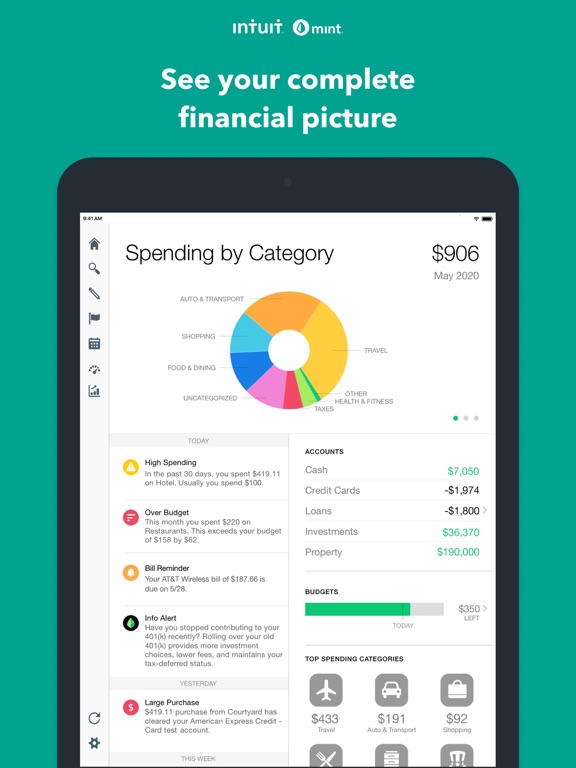

There's no better way to manage your money than by using the Mint: Money Manager, Budget & Personal Finance app. This app has been designed so you can see all your finances in one spot, which then gives you the ability to create a customized budget. View your accounts, investments, and credit cards. After you have all your information set up you can also put together bill reminders so you don't ever forget to pay on time. There are basic and advanced tools here such as being able to graph and chart your spending, view your own personal trends, and get information on how you can save money.

Mint.com Personal Finance app review

- View all your accounts, investments, and credit cards in one handy spot

- Create a personalized budget through the app

- View your spending trends on charts and graphs

- Set up bill reminders

- There are a number of basic and advanced tools to use

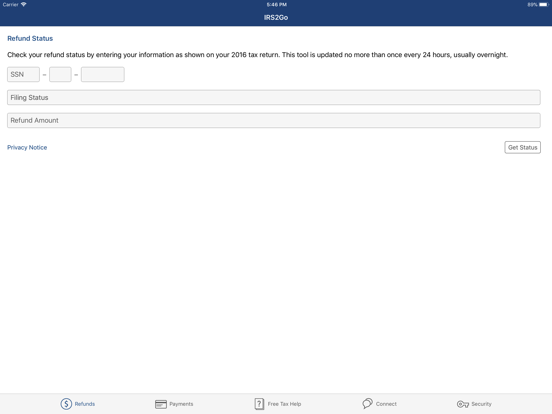

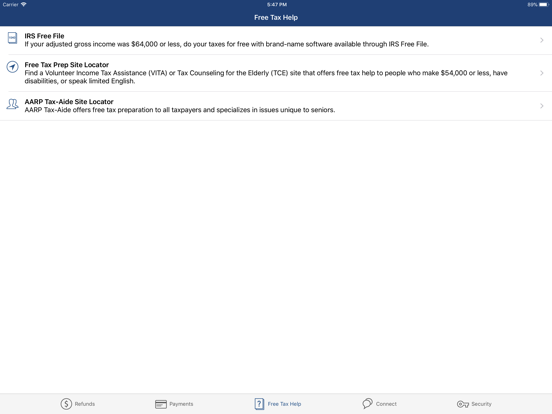

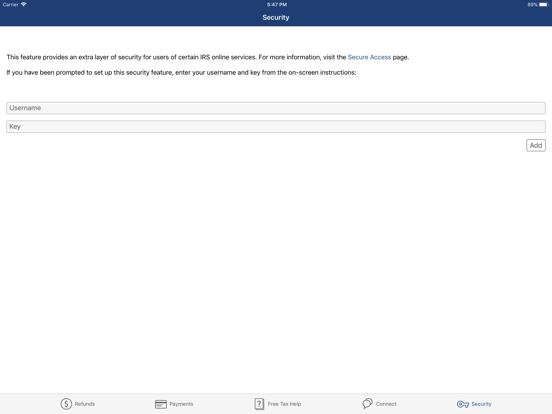

If you're looking for a professional and reliable source of information then you can't find any better than the IRS2Go app, which is the official app from the Internal Revenue Service. Through this app you'll be able to access tax tips that can help you prepare your taxes, tax preparation help that is completely free, and you can also check on the status of your refund. The app also gives you access to the IRS's social networks - YouTube, Tumblr, and Twitter, giving you the ability to stay on top of all the latest information and news.

- Provides users with access to the official app from the Internal Revenue Service

- Get tax tips that can save you money and get help preparing your taxes for free

- Use the app to get access to your refund

- Access the IRS’s Twitter, Tumblr, and YouTube feeds

- The app is very easy to navigate

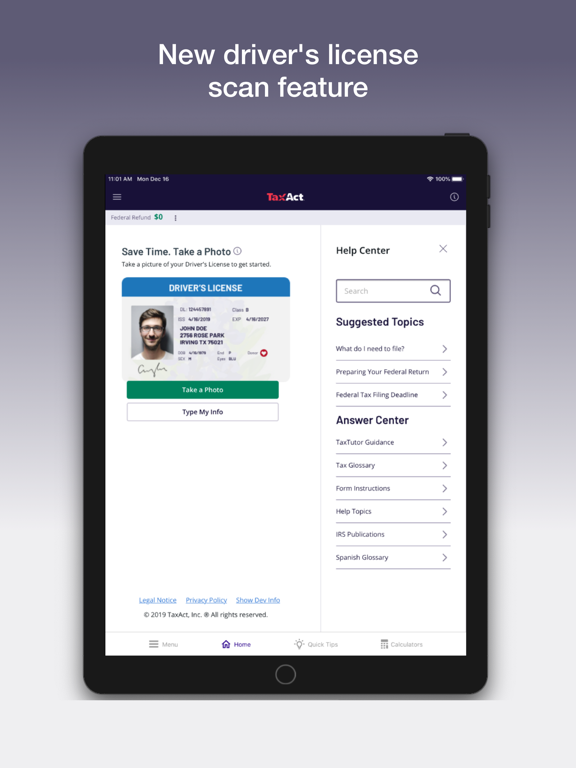

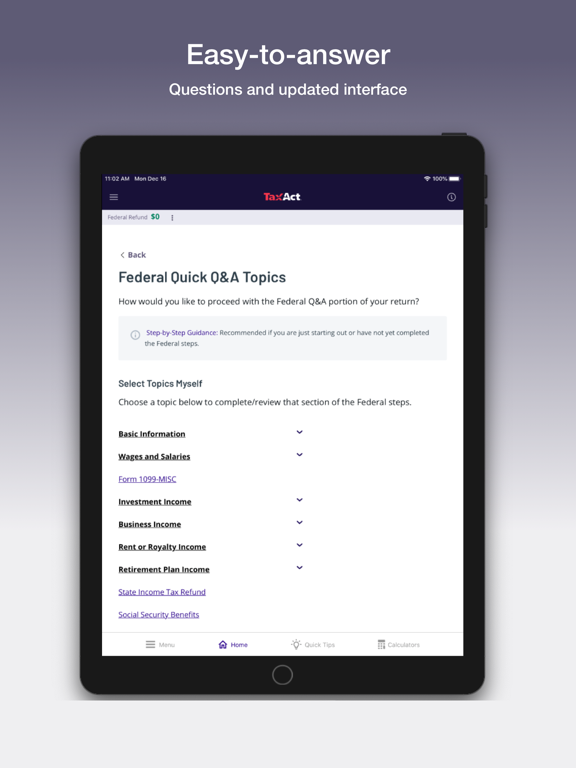

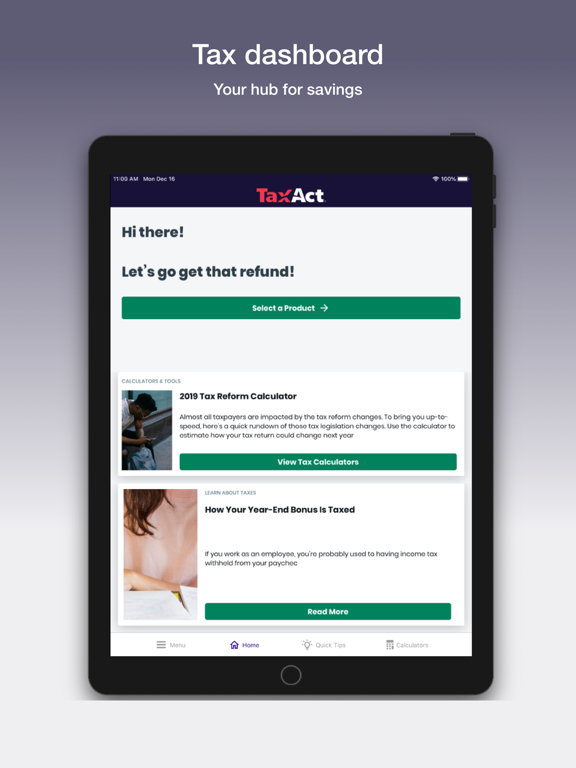

Filing your taxes can be as easy as one, two, three when you have the proper tools available to you. The TaxACT Express app can be used to put together your tax return and then e-file it all from the same app. This app supports both state and federal 2014 tax returns. The app takes into account all kinds of tax situations that can affect your return such as interest income, dependents and dependents credits, earned income credit, unemployment compensation, and more. If you find you need that extra bit of help there is one-on-one assistance available. You can also track the status of your refund through the app.

- Prepare and then e-file your 2014 state and federal tax returns

- The app takes into account all kinds of different tax situations that can affect your return

- There is one-on-one assistance should you require it

- You can track the status of your refund right through the app

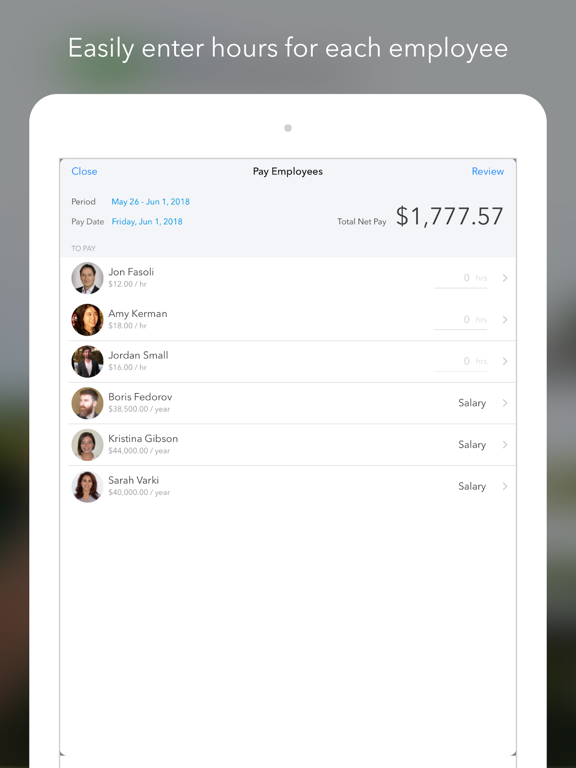

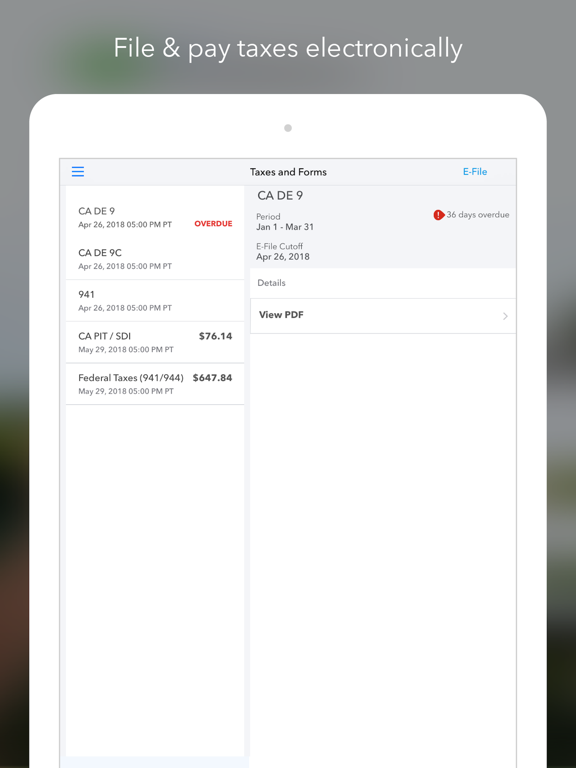

Do you work in the payroll department and need a mobile way to work on your accounts? The Online Payroll app has been created to seamlessly sync with your Intuit Payroll account and gives you all kinds of tools to perform your job from any place and any time. The app allows you to make paychecks, pay employees with direct deposit and not pay a fee on it, e-file forms, e-pay your taxes, check out your past paychecks, and even set up reminders for deadlines. If you find you need a little extra help there is expert payroll support free of chard that is available Monday through Friday from 6am-6pm PT.

- The app gives users the ability to perform payroll activities even while on the go

- Receive expert advice through the app Monday through Friday from 6am-6pm PT

- Make paychecks, view past ones, set up direct deposits for free, e-file a variety of forms, and e-pay your taxes

- The app allows your sync with your Intuit Payroll account

- Set up reminders for deadlines

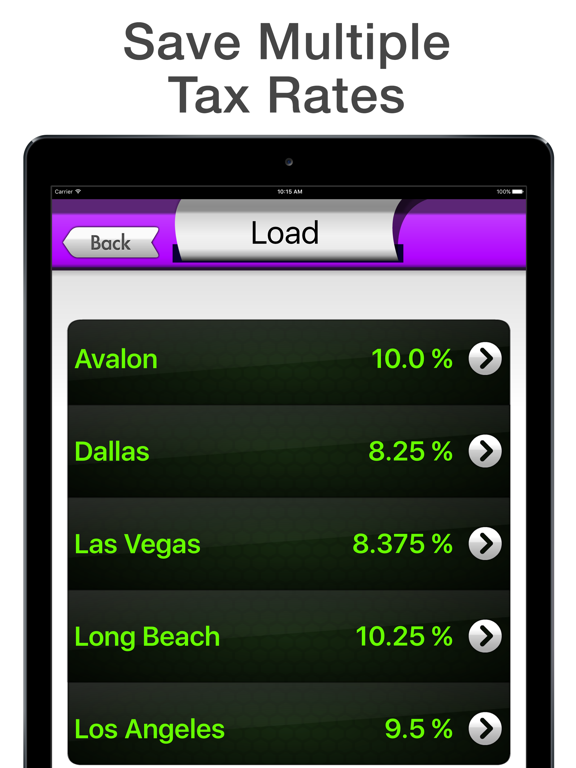

Instead of trying to calculate in your head how much your purchase will come out to once the sales tax is added here's a way to get an instant and accurate answer. The Sales Tax Calculator FREE Tax Me app has been created to let you key in prices and get instant totals with sales tax. The app is versatile in that you can save a variety of tax rates. As another bonus you can use a wide variety of currencies. This one is a simple yet effective offering that will take all the guesswork out of shopping.

Sales Tax Calculator FREE app review

- Get instant totals for your bill with the tax rate included

- Save multiple tax rates

- The app supports a large variety of currencies

- The user interface is simple and basic allowing you to perform calculations easily

- The app also features a built in calculator so you can add up totals first

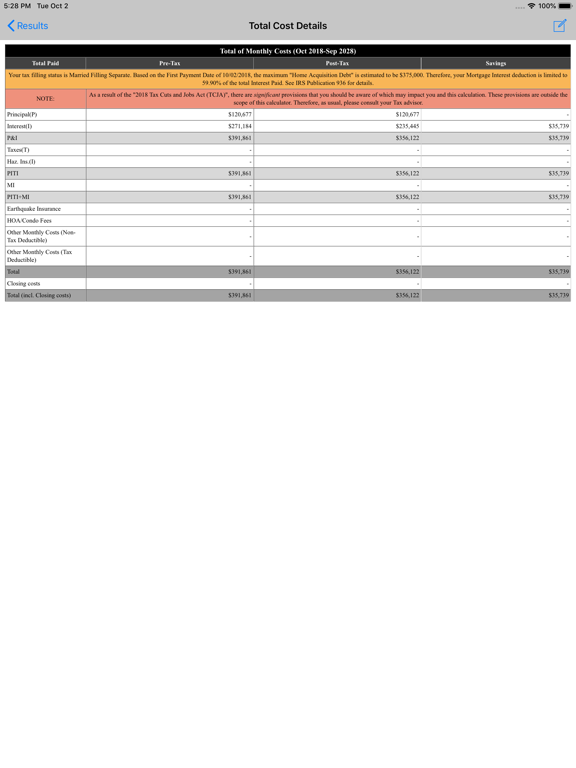

If you're thinking about getting a mortgage, breaking down the numbers on the spot is next to impossible. The Loan Calc makes it possible to get an instant and accurate calculation of what the mortgage payment will be each month. As an added bonus you can also see how the tax savings will change the mortgage payment and can suddenly make it all the more affordable. This app can literally be used as you walk through the potential home you may buy, while you're sitting in the bank waiting to meet with the lender, or just at home as you're trying to figure out what you can afford.

- Figure out what you can afford instantly with this app

- Figure out how the tax savings of a mortgage can influence the payment and can make it more affordable

- The app can be used anywhere

- Set the loan term and enter in the other specifics

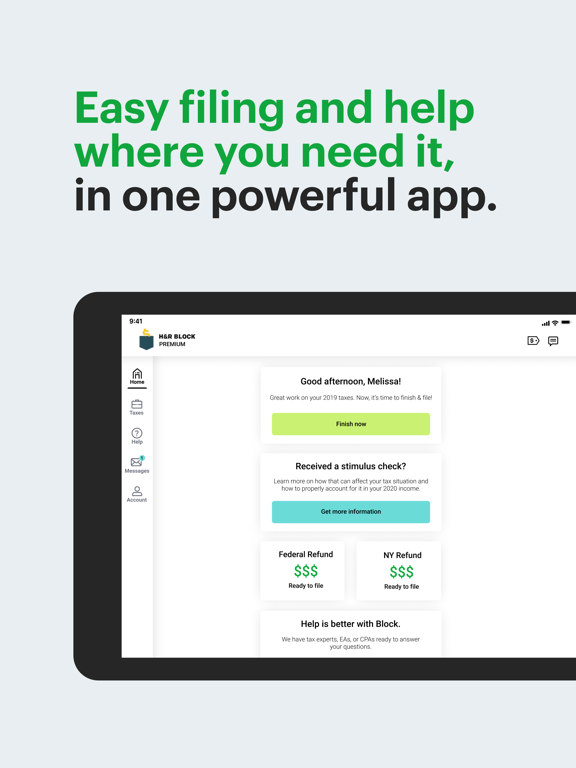

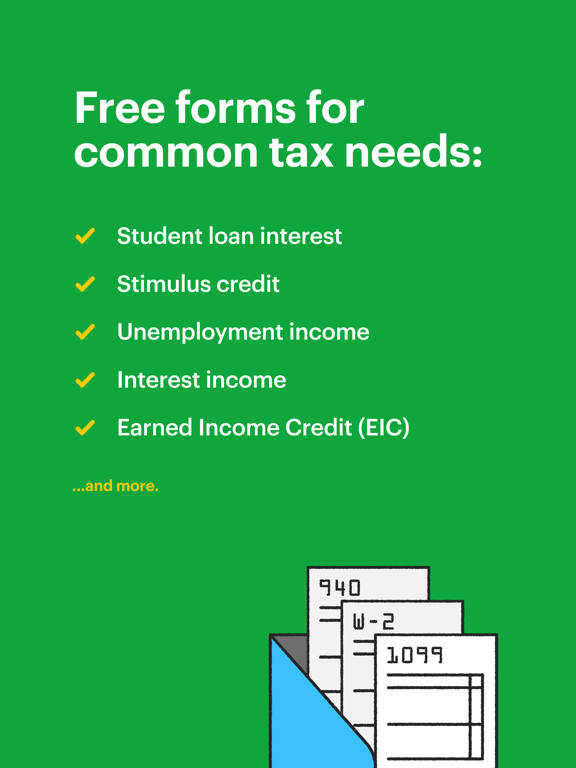

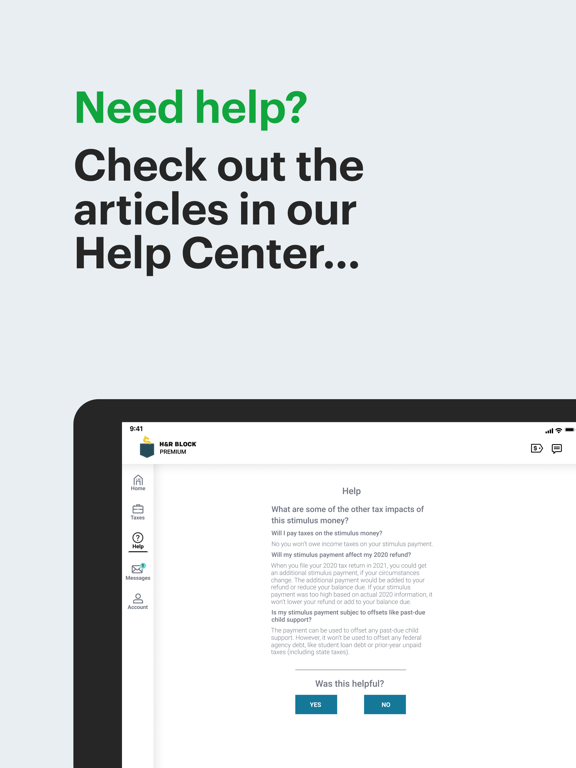

Say hello to great tax preparation and upfront pricing with this iPhone app for doing your own taxes as one of the highest-rated tax prep apps, it’s easy to see why Block has your back. Use a different preparer last year? In this tax preparation app, you can switch quickly and easily when you file with H&R Block, plus get access to an H&R Block tax expert, enrolled agent, or CPA if you need one. With more than 60 years of tax preparation experience on your side, you can be sure you’re getting your maximum refund -- guaranteed.

- Credits and deductions other tax prep services

- Student loan interest, tuition and fees, Social Security income, and unemployment income

- Get a free mid-year tax check-in and free audit assistance

- Prepare your return, get help, and use all app features without paying a dime upfront