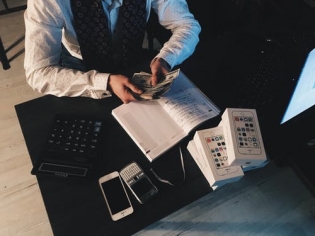

Entrepreneurs and small business leaders are finding it difficult to figure out how to manage the finances and their business during this Covid-19. There’s so much to be done with the little resources that are available, and it feels like navigating your way through a maze.

If you lack the experience to manage your finances in hard times, it could feel like a chore, and your lack of financial expertise can make the impact of the pandemic to be more pronounced in your business.

There are ways to manage the finances of your business in such a trying time as this. To help you with those ways, we’ll be introducing you to some tips on managing your business’s finances:

1. Reduce Cost as much as possible

If you’re a small business owner, I’m pretty sure that one of the first decisions you took at the beginning of the pandemic is to rethink your finances. You probably felt that the pandemic would soon phase off, and you kept your budget intact. But since that’s not the case, you need to shed off some of your Cost as soon as possible.

It is extremely important to do this, as you don’t want to find yourself in financial hardship. May it be from you exploring the pros and cons of bankruptcy, to taking a chapter 13 calculator, it is extremely important to reduce costs as much as possible.

Here are steps you can take to cut down on costs:

List your variable and fixed Costs

Depending on your industry and the business model you’re operating in, it’s much easier to cut down on variable costs than to do the same to fixed costs. For example, can you opt for a cheaper way to ship your products? Is it possible to reduce the sales commission of your personnel and find other ways to incentivize them? If possible, can you alter some fixed costs to variable costs?

Basically, try getting rid of anything the business cost that you can do without. This is the time to begin practicing running at a lean cost.

Seek Help

Your business exists in an ecosystem where businesses and people depend on the existence of your business to make their own profit. As such, don’t be shy to ask for help since preventing your business from insolvency works in their interest.

Try to explain where your business is right now and where it might be in some months to come. For example, if you can pay your rent this month, but it seems you’ll have some challenges doing so in two months’ time, then it’s best to explain this to your landlord.

2. Place Priority on generating cash over turning a profit

The profit from your business is your total sales after the Cost of producing your goods have been factored in. But making a profit does not necessarily equal a positive cash flow, which is what you need right now. You can reprioritize or adjust the actions you take to regenerate profit to improve the cash you generate.

Here are some ideas to increase cash generated:

Give existing customers exclusive discounts

It’s less expensive to increase sales from existing customers to gaining new customers.

The difficulty is even more hardened with the raging pandemic as millions of breadwinners have lost their source of livelihood. Also, the incomes of most Americans have been greatly reduced, which will make them hesitant to spend.

Repackage your service or product for the consumer market

Suppose the majority of your product is sold in an office space or one that reaches your consumer by using middlemen. It’s best to task your marketers to come up with rebranding strategies and have an effective landing page. This can help ensure that your service/product reaches your target market directly.

Fill a niche in your neighborhood

Platforms like Amazon have prioritized the delivery of household items in a move to reduce the number of people that visit a physical store. You might also want to sell household products that are high –demanded online in a bid to raise your income.

3. Empower your team

Business leaders often encourage their team with words like “we’re in this together” without taking actions that reflect that to the team. As an entrepreneur/business owner, this is the period where you have to leave the comfort of your office space. It’s time to lead from the field.

Try to engage your employees on the goals and metrics of your business in this pandemic. It’s best to be transparent about your real business metrics, no matter how poor it is. If you open up on what your business needs to stay afloat, you’re giving them a reason to work hard.

In addition, it’ll be helpful if you communicate the level of trust and respect you have for them.

In Summary

You don’t want to have to file bankruptcy although some individuals may have to from time to time. There are times when you may have to file for chapter 13 after chapter 7, which is a sign of never ending financial hardships, so let’s dive into ways to prevent this.

Managing a business during this covid-19 pandemic period can be nerve-wracking. However, it is imperative that you keep your business afloat by managing your business finances if you plan to stay in business for long. This might prove difficult, but the tips we’ve given in this article can help.